Letzte Änderung: Januar 31, 2025

Pachteinnahmen-Anleihe

Pachterlösanleihen ermöglichen es Schulbezirken, den Bedarf an Gebäuden zu decken. Lease Revenue Bonds werden vom Bildungsausschuss genehmigt, der als kommunale Baubehörde einberufen wird.

Der Provo City School District plant, am 25. Februar 2025 eine Lease Revenue Bond zu begeben. Diese Anleihe wird zur Deckung der folgenden Bedürfnisse ausgegeben:

Timpview-Bedarf

Bei der Verabschiedung der Anleihe für Timpview im Jahr 2019 ging es um den Wiederaufbau des akademischen Haupttrakts und des Tanz-/Schließfachtrakts. PCSD konzentrierte sich auf die Bereiche mit dem größten strukturellen Bedarf. Während des laufenden Umbaus wurde festgestellt, dass die übrigen Gebäudeteile in einem schlechteren baulichen Zustand sind als ursprünglich angenommen. Ingenieur- und Architekturexperten rieten dem PCSD, diese verbleibenden Bereiche der Schule so schnell wie möglich zu sanieren:

- Kunstflügel

- Verwaltungstrakt

- CTE-Flügel

- Neugestaltung der Cafeteria

Dixon-Site-Bedarf

Als die Dixon Middle School an einem neuen Standort als Shoreline Middle School wiederaufgebaut wurde, teilte der PCSD der Nachbarschaft seinen Wunsch mit, den Dixon-Standort für die Bedürfnisse des Distrikts zu nutzen und ihn gleichzeitig als positiven Ort für die Nachbarschaft zu erhalten.

Der PCSD führt derzeit eine Machbarkeitsstudie durch. Auf der Sitzung des Schulrats am 11. Februar 2025 werden die Ergebnisse dieser Machbarkeitsstudie dem Schulrat vorgestellt. Der PCSD prüft auch, wie der Bedarf an beruflicher und technischer Ausbildung (CTE) für Schüler der Sekundarstufe besser gedeckt werden kann. Eine vorherrschende Idee ist der Bau eines CTE-Zentrums auf dem Dixon-Gelände. Diese Entscheidungen werden nach Erhalt der Informationen aus der Machbarkeitsstudie getroffen.

Vorteile einer Pachteinnahmenanleihe

Lease Revenue Bonds können zu jeder Zeit im Jahr genehmigt werden und müssen nicht auf den Zeitpunkt eines Wahlzyklus warten. Dies ist wichtig für den Zeitplan von Timpview. Die Schule und die Nachbarschaft haben den Wunsch geäußert, die Bauarbeiten voranzutreiben und das Projekt so schnell wie möglich abzuschließen. Wenn wir jetzt eine Mietkaufanleihe auflegen, wird dies erleichtert.

Traditionell ist der Zinssatz für eine Leasinganleihe höher als für eine allgemeine Obligationsanleihe (über die die Öffentlichkeit im November abstimmt). Im Moment sind die Zinssätze jedoch praktisch gleich hoch. Der Schulbezirk und der Bildungsausschuss wollen mit den Steuergeldern gut umgehen und sich jetzt um diese Projekte kümmern - die Baukosten werden nur steigen - ohne dabei mehr Zinsen zu zahlen. Der Schulbezirk hat mehrere öffentliche Versammlungen abgehalten und positive Rückmeldungen dazu erhalten.

Details zur Mietertragsanleihe

- Die Anleihe beläuft sich auf $70 Millionen

- Deckt den Rest des Timpview-Umbaus ab

- Bezahlt für die Entwurfsphase der Dixon-Site

- Der Vorstand beabsichtigt, in einigen Monaten ein anderes LRB für Dixon zu genehmigen, sobald wir die genauen Details kennen.

Zeitplan für Pachtertragsanleihen

- Januar 28, 2025 Der Schulausschuss stimmte über eine Absichtserklärung zur Ausgabe von Pachtertragsanleihen ab.

- 11. Februar 2025 Der Schulausschuss wird die Anleihe in einer Studiensitzung des Ausschusses erörtern. Die Ergebnisse einer Machbarkeitsstudie werden dem Schulausschuss ebenfalls vorgestellt. Die Öffentlichkeit kann während der Geschäftssitzung um 19.00 Uhr Kommentare abgeben.

- Februar 25, 2025 Der Schulausschuss wird eine offizielle Anhörung abhalten und über die Genehmigung der Lease Revenue Bond abstimmen. Die Öffentlichkeit kann sich während der Anhörung um 18:00 Uhr äußern.

- April 2025 Wenn die Anleihe auf der Sitzung am 25. Februar genehmigt wird, wird ein Teil der Anleihen ausgegeben, um die nächste Phase des Timpview-Projekts einzuleiten und mit der Planung des Dixon-Geländes zu beginnen.

Steuerliche Implikationen

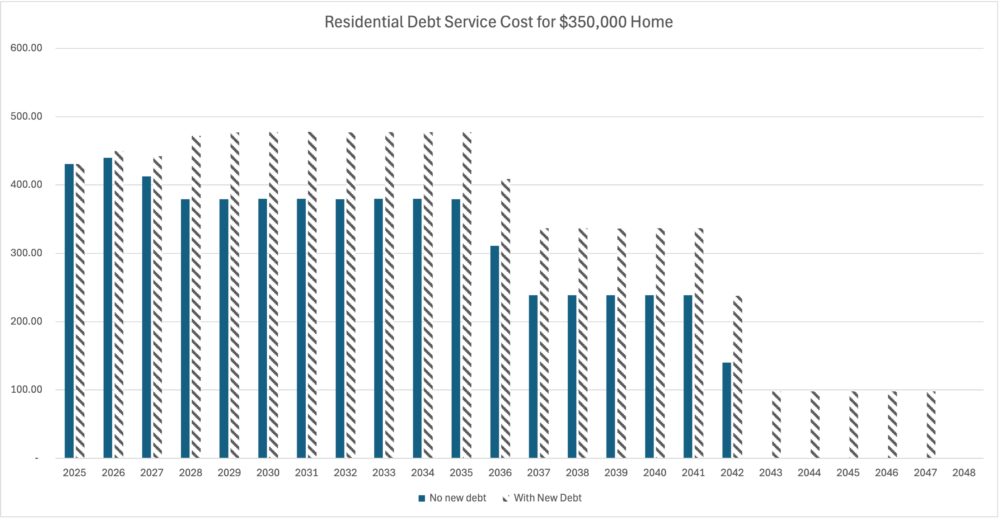

Schuldendienstkosten für $350.000 Haus

Nachfolgend finden Sie eine Grafik und eine Tabelle mit den Schuldendienstkosten für ein Haus mit einem Wert von $350.000, wobei zwischen keiner Neuverschuldung und der Hinzufügung der Mietkaufanleihe unterschieden wird.

Jahr |

Keine Neuverschuldung |

Mit neuer Verschuldung |

|---|---|---|

2025 |

$430.97 | $430.97 |

2026 |

$439.54 | $450.01 |

2027 |

$412.56 | $442.28 |

2028 |

$379.44 | $472.14 |

2029 |

$379.26 | $477.11 |

2030 |

$379.59 | $477.43 |

2031 |

$379.75 | $477.60 |

2032 |

$379.22 | $444.06 |

2033 |

$379.63 | $477.48 |

2034 |

$379.55 | $477.40 |

2035 |

$379.43 | $477.40 |

2036 |

$311.05 | $408.90 |

2037 |

$238.75 | $336.59 |

2038 |

$238.68 | $336.53 |

2039 |

$238.66 | $336.51 |

2040 |

$238.71 | $336.55 |

2041 |

$238.69 | $336.54 |

2042 |

$140.15 | $237.99 |

2043 |

– | $97.84 |

2044 |

– | $97.84 |

2045 |

– | $97.84 |

2046 |

– | $97.84 |

2047 |

– | $97.84 |

2048 |

– | – |

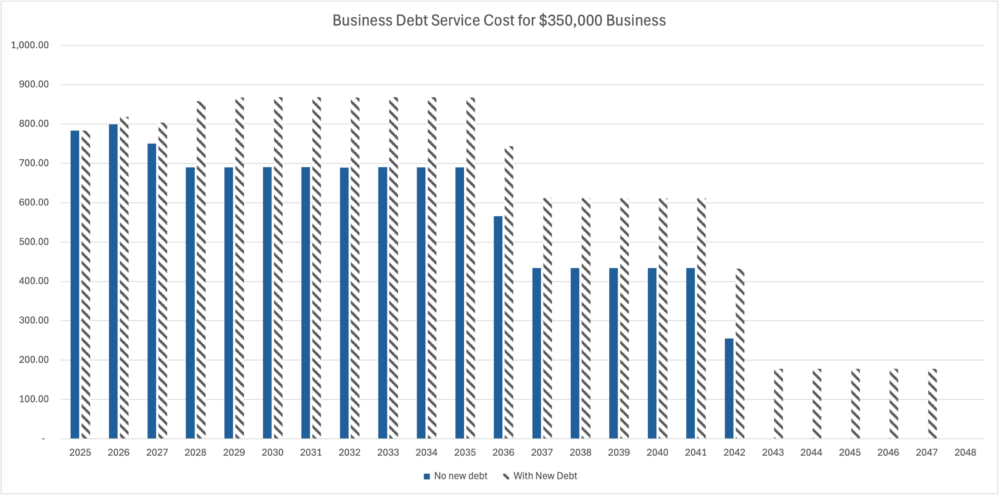

Schuldendienstkosten für $350.000 Unternehmen

Nachfolgend finden Sie ein Diagramm und eine Tabelle zu den Schuldendienstkosten eines Unternehmens mit einem Betrag von $350.000, wobei zwischen keiner Neuverschuldung und der Hinzufügung der Leasinganleihe unterschieden wird.

Jahr |

Keine Neuverschuldung |

Mit neuer Verschuldung |

|---|---|---|

2025 |

$783.57 | $783.57 |

2026 |

$799.17 | $818.20 |

2027 |

$750.11 | $804.15 |

2028 |

$689.89 | $858.44 |

2029 |

$689.57 | $867.47 |

2030 |

$690.16 | $868.06 |

2031 |

$690.46 | $868.36 |

2032 |

$689.88 | $867.39 |

2033 |

$690.25 | $868.14 |

2034 |

$690.10 | $868.00 |

2035 |

$689.88 | $867.39 |

2036 |

$565.55 | $743.45 |

2037 |

$434.08 | $611.98 |

2038 |

$433.97 | $611.87 |

2039 |

$433.94 | $611.83 |

2040 |

$434.01 | $611.91 |

2041 |

$433.99 | $611.89 |

2042 |

$254.80 | $432.71 |

2043 |

– | $177.90 |

2044 |

– | $177.90 |

2045 |

– | $177.90 |

2046 |

– | $177.90 |

2047 |

– | $177.90 |

2048 |

– | – |