Provo CAPS Spring Showcase 2024

April 23rd, 2024

Provo CAPS Spring Showcase, an evening of client-based project presentations completed by CAPS...

With Election Day right around the corner, understanding what the district is proposing with the 2020 Bond becomes increasingly important. Recently, we mailed out a Voter Information Packet to every residence in Provo, below is the information it contained:

Election day is Tuesday, November 3, 2020. Please contact your county clerk with questions. For more voting information or for election day voting centers, locations, changes, or additions, visit: Vote.Utah.gov; Utah County Clerks Office 801-851-8125; utahcounty.gov/Dept/ClerkAud/index.asp or Provo City School District at Stefb@provo.edu or 801-374-4800.

Below is the ballot language that will appear on the official ballot as required by Utah State law.

The board expects to borrow the full $80 million in one issue. The tax impact shown represents the cost to taxpayers the first year after bonds are issued. Subsequent years the tax impact will decrease.

For the Provo City School District, Utah Special Bond Election

November 3, 2020 /s/ Stefanie Bryant Business Administrator

PROPOSITION

Shall the Board of Education (the “Board”) of Provo City School District, Utah (the “District”), be authorized to issue General Obligation Bonds in an amount not to exceed Eighty Million Dollars ($80,000,000) (the “Bonds”) for the purpose of paying all or a portion of the costs to partially rebuild Timpview High School; said Bonds to be due and payable in not to exceed twenty-one (21) years from the date of issuance of the Bonds?

Property Tax Cost of Bonds: If the Bonds are issued as planned (and without regard to the existing taxes currently paid for existing bonds that will reduce over time), a property tax sufficient to pay debt service on the Bonds will be required over a period of twenty-one (21) years in the estimated average amount of $110 per year on a $317,000 primary residence and in the estimated amount of $200 per year on a business property having the same value.

The District has other outstanding bonds for which a tax decrease would occur upon the retirement of such outstanding bonds, which may not occur if the proposed Bonds are issued. However, the combination of the retirement of the outstanding bonds and the issuance of the proposed Bonds, as planned, is expected to result in a property tax rate increase in the estimated average amount of $70 per year on a $317,000 primary residence and in the estimated amount of $128 per year on a business property having the same value within the District from current levels.

The foregoing information is only an estimate and is not a limit on the amount of taxes that the Board may be required to levy in order to pay debt service on the Bonds. The Board is obligated to levy taxes to the extent provided by law in order to pay the Bonds. The amounts are based on various assumptions and estimates, including estimated debt service on the Bonds and taxable values of property in the District.

The Board has sought input from various building experts to understand the needs at Timpview. The conclusion of those studies is that Timpview is in a condition of continued deterioration. The proposed bond is to ensure that existing deterioration is remedied to keep students safe. The rebuild includes site drainage and soils remediation for the improved areas. Newly built portions will be on seismic piers.

The Provo City School District Board of Education is proposing an $80 million bond issue for a partial rebuild of Timpview High School. The academic wing and south gym will be rebuilt over a 2 ½ year period. Construction is estimated to begin in March of 2021. Bonds will be issued in winter or spring of 2021 and used to pay construction costs as they are incurred. The bond proceeds will be used to cover architect fees and construction costs, as well as furnishings for the newly built portions.

The issuance of the proposed bond will result in an estimated net increase of $70.75 a year or $5.87 monthly on the average primary residence. It is estimated that the impact to a business of the same value will be $128.08 a year or $10.68 monthly.

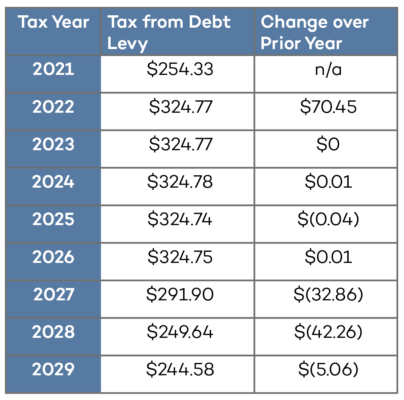

The table below is the estimated cumulative total tax impact for a residential household with a house valued at $317,000.

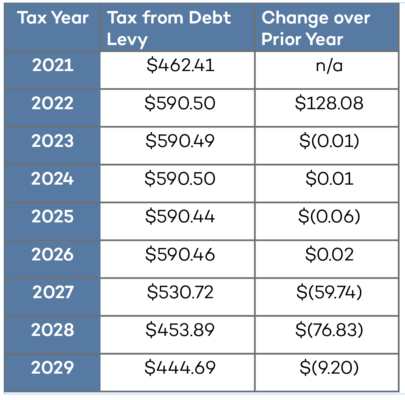

The table below is the estimated cumulative total tax impact for a business with a business valued at $317,000.

The decision to bond is one that the Provo City School District Board of Education takes very seriously.

The Board of Education and Provo City School District are committed to integrity and transparency through this entire process. Information has been and will be posted online. Financial information will be available on the website for transparency and to ensure appropriate use of the bond funds.

he district will use efficient design, construction, and procurement methods to maximize taxpayer dollars for the bond projects. If the actual cost is below the estimates, the board will then prioritize remaining capital needs. In the unlikely event that due to sudden economic changes this bond is not enough to complete all projects, the board will have to re-prioritize its capital needs to make additional funds available.

It is important to note that when new bonds are issued, existing bonds are phased out. Consequently, the increase of $5.87 Per month will decrease in subsequent years.

The district has a proven record of financial responsibility. Provo City School District has received the Certificate of Achievement for Excellence in Financial Reporting for the Comprehensive Annual Financial Report for the past 17 years and the Popular Annual Financial Report for the past 10 years. The district has also received the Distinguished Budget Presentation Award for the past 12 years. The awards are presented by the Government Finance Officers Association and Association of School Business Officials International.

This voter information pamphlet includes content provided by Zions Bank Public Finance and Gillmore Bell Bond Counsel.

Provo CAPS Spring Showcase, an evening of client-based project presentations completed by CAPS...

We love having the opportunity to explore the district and meet the incredible teachers, ESPs, and...

April 11, 2024 Grade 6 Teacher—–Provost April 12, 2024 Asst 1/Food...